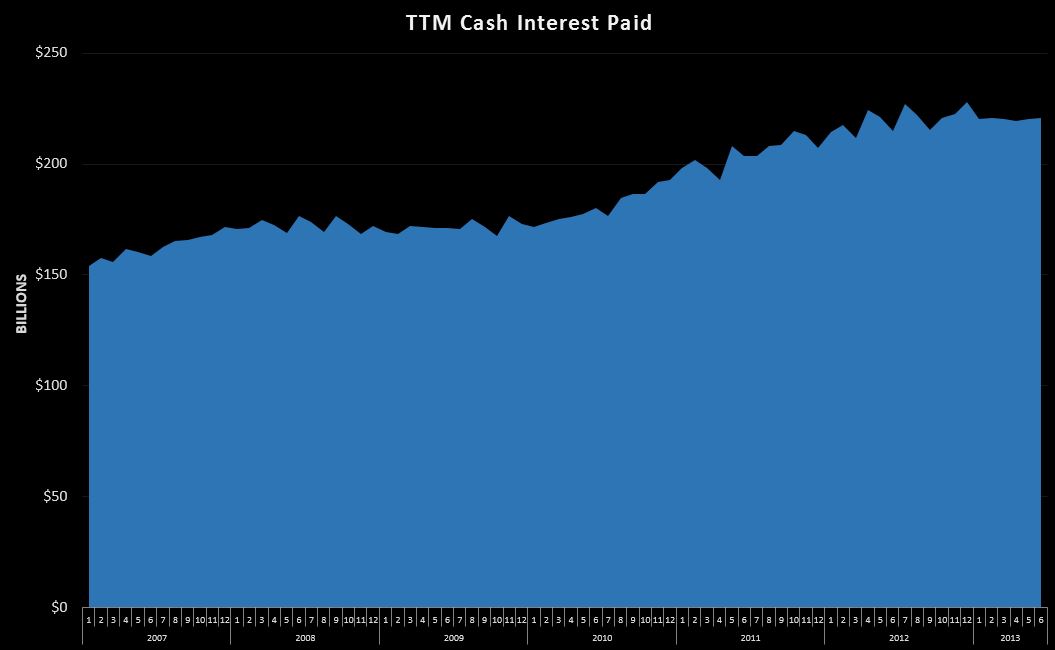

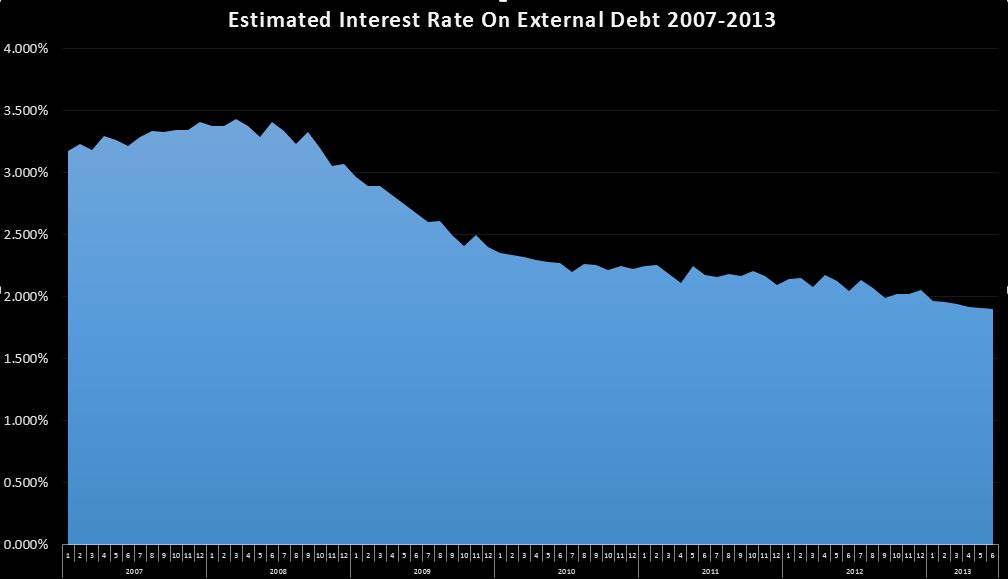

Yesterday I did a brief analysis of interest payments, which make up about 5% of our annual outlays. My conclusion was that rising interest rates will ultimately blow this category sky high, but for the time being…at least a couple years or so, I don’t expect this to be a huge problem because rates are incredibly low, and more or less locked in for long enough to blunt any sudden move in rates.

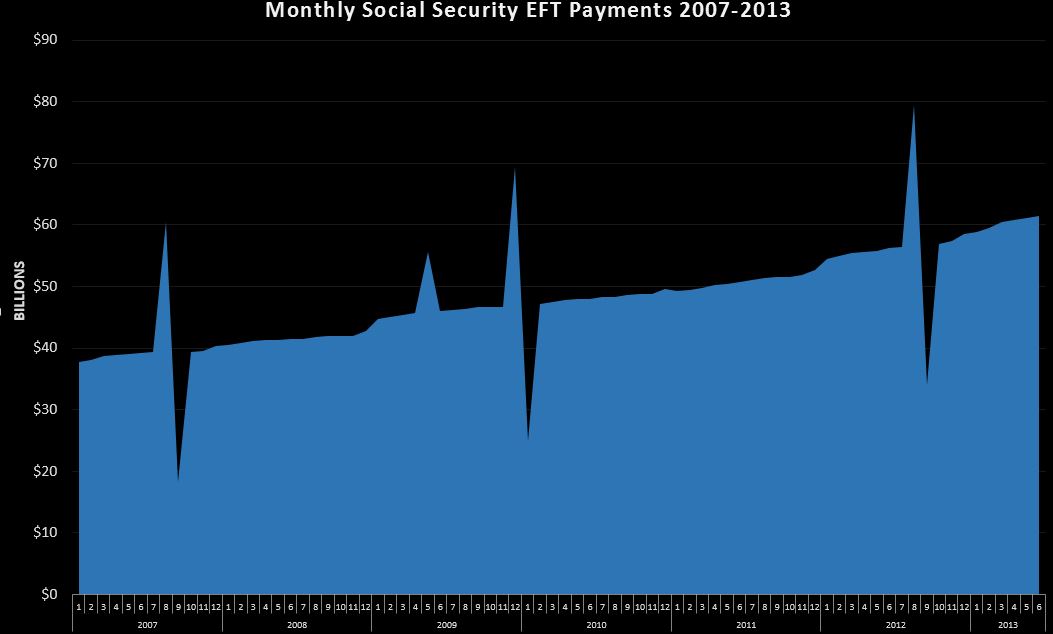

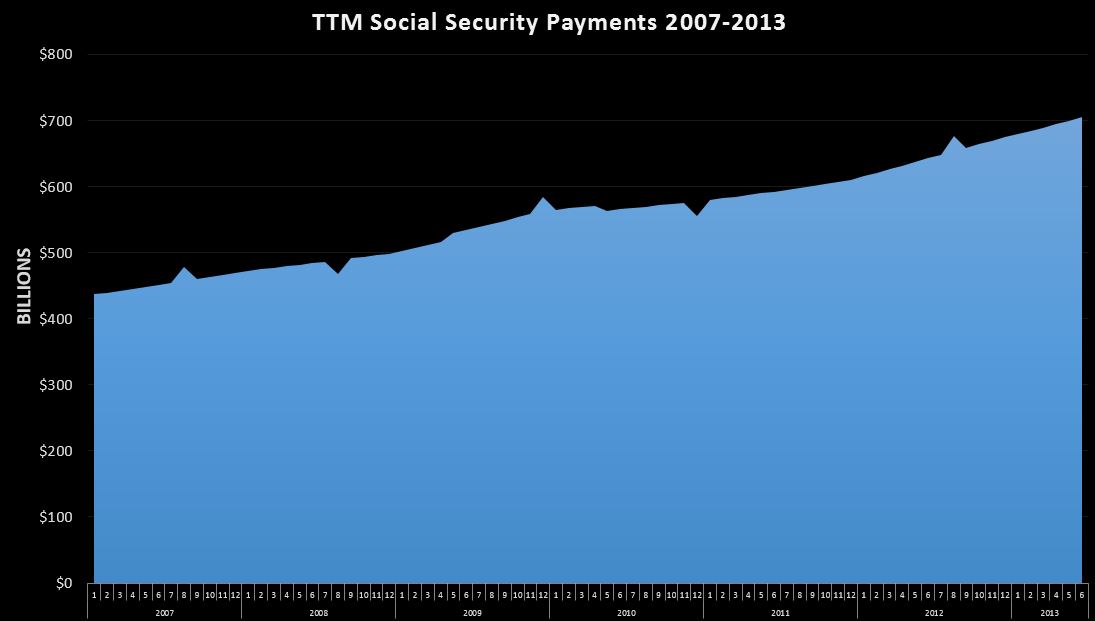

Today, I want to take a similar look at Social Security, which is a problem now, and will continue to be. So…looking back at 2007 for some scale…in January, Social Security EFT were $38B, $469B for the whole year. Fast forward to May-2013…the monthly outlays were $61B, and the TTM was $700B….18% of all cash outlays over the past 12 months.

One quick note. On the DTS…only payments made by electronic transfer are captured…paper checks, though a small %…fall through to “other”. In the past, I have seen estimates that in the past 90%-95% of social security payments were electronic transfers. Obviously, this population would not stay constant. I think it would be a safe assumption that the paper checks go to the older recipients at a higher rate than younger (relatively 🙂 ) recipients. So…as the older recipients with paper checks pass away, and are replaced by younger recipients who prefer direct deposit…the$ of SS EFT’s would grow…even if SS total payments were constant…somewhat skewing our analysis. Early this year, they actually made a push to eliminate paper checks…not sure how successful that was, but there were some notable upward blips in the data consistant with this, so it is probably safe to say that there are only a few % left. All together, I think the population of paper checks, and the rate of change associated with it are small enough to more or less ignore…I just wanted to put it out there for full disclosure.

So let’s start with the charts:

The monthly:

and the TTM:

So the first question you probably have…what are those huge saw-tooth looking swings? Most of these are caused by timing…where the first social security payment due the third of the month is pulled into the prior month due to weekends/holiday ect… This causes a spike, then dip that is very prominent in the monthly, and even apparent on the TTM. This isn’t common, but it does happen every year or so. There is one additional spike in May-2009 related to stimulus…I believe about $13B of extra payments were made in an effort to buy votes stimulate the economy.

The charts are clear…Social security is huge, is growing, and that growth is expected to accelerate over the next 10 years. I’m no actuary, but I recently looked at some age tables a while back and the next 10 years should see a accelerating growth as we get into the meat of the Boomer generation. For example…per the data I have… about 2.7M people will turn 65 in 2013. next year spikes up to 3.7M…trending up to around 4.5M per year by 2025.

Note…the SS population is in constant flux…people retire every day, and people pass away every day. Right now…we seem to be adding about 125k people per month to the program(consolidated…retirement and disability ect…), with a year over year growth of about $60B per year and headed higher. So in the context of the entire budget…just to stay even each year…you have to come up with an additional $60B+ per year of cuts or new revenue…in perpetuity just to stay even. A year or two…we can probably cough up…but after 10 years…you are talking about a huge hole that appears to be too massive to fix.

This is the ticking time bomb I expect to blow the budget apart in the long run. From $700B per year now….in just five years…June 2018 assuming 6-7% annual growth, we will cross the $1T per year threshold. Who thinks we will elect someone in 2016 on a “cut social security” platform?? Didn’t think so. Over 57M people currently get checks each month….with 60M or so Boomers in line for their cheese…..The math suggests a very unhappy ending for all.