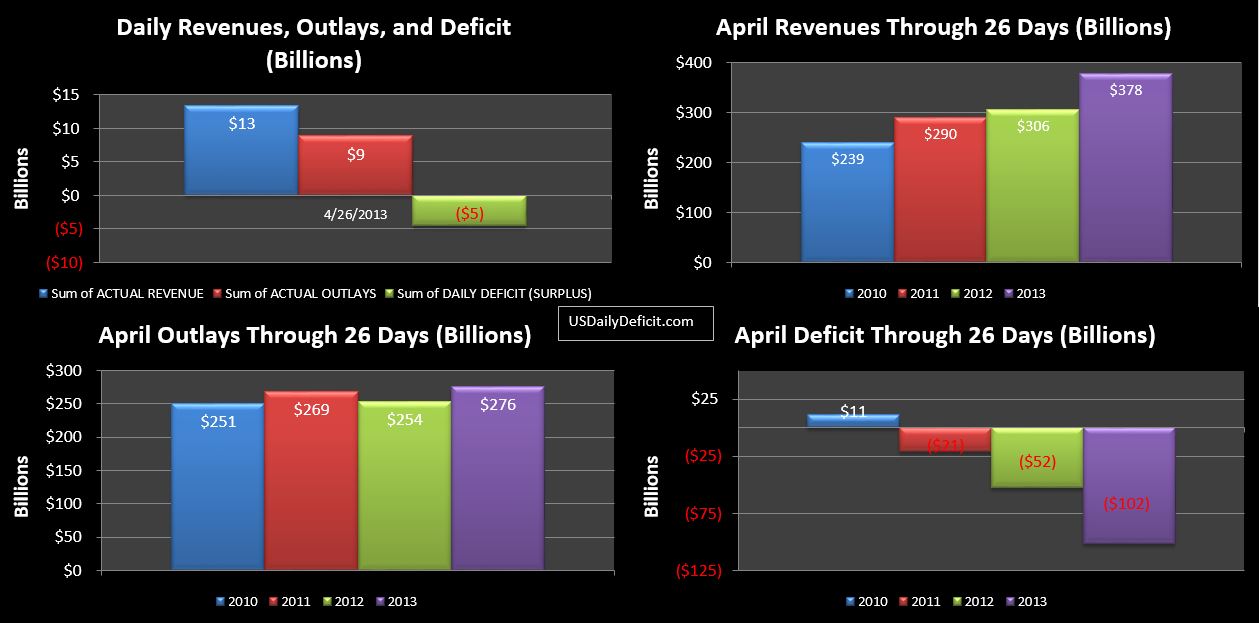

The US Daily Cash Surplus for 4/26/2013 was $4.6B. Revenues continue to outpace April 2012 by a healthy 23% pace, but are following a similar downward slope the further we get from 4/15. The 4/2013 surplus through 26 days stands at $102B with 2 business days remaining. This is likely to continue growing with strong Monday revenues today, $110B seems possible, but end of month is often tricky to forecast…sometimes we see large outlays flow through…I am expecting $8B or so of interest payments 4/30…and I never know when Medicare payments are going out…so a spike there could offset an otherwise strong finish.

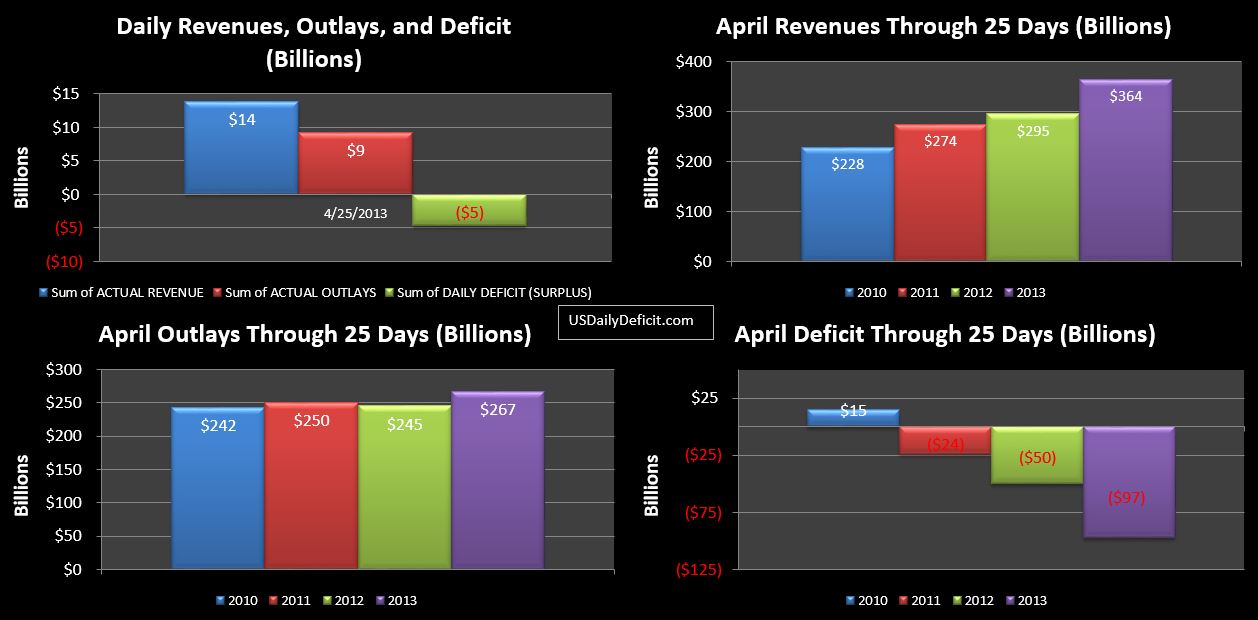

The US Daily Cash Surplus for 4/25/2013 was $4.7B…pushing us back into surplus after yesterday’s brief return to normalcy. The category “Individual Income and Employment Taxes Not Withheld” continues to lead the charge. This category represents taxes not withheld directly from a paycheck…for example if you owed taxes and mailed a check on 4/15… Or if you were an investor with a large capital gains.. YOY through 25 days, this category is up from 131B in 4/2012 to $174B in 4/2013. This is good for about 65% of the total $69B revenue gain we’ve seen, with the balance being in Corporate Taxes, Taxes withheld, and other misc. categories. Withheld taxes are up about 8.4%…consistent with the rest of the year.

With 3 days left, the main thing I am interested in is the YOY interest payments…last year they came in at $15.3B for the month. Debt has increased about $1T in the last year, but effective interest rates have inched down a bit as well. I’m not expecting any huge changes, but this is one of the categories I keep a close eye on because if/when treasury loses control of interest rates, it’s pretty much game over because zero% is just about all we can afford to pay anyway. As of the end of March, I had the effective rate at 1.85%. A jump of just 1% would mean an additional $120B per year of deficits….a number that will grow along with our debt once we say goodbye to April.

The US Daily Cash Deficit for 4/24/2013 was $2.7B, breaking a nearly 2 week string of surpluses as the final round of SS payments went out, pushing cost over still strong revenues. At $350B in net cash revenues, we are already ahead of last April’s $330B and well within reach of $400B. This wouldn’t be an all time high…April 2008 would still hold that at $430B of revenue and a $188B surplus. Curiously, 5/2008 went on to post a $154B deficit, nearly wiping out all of the gains from April’s record surplus. Doh!!

With 4 business days remaining, $105B looks like a good deficit estimate…factoring in 1 extra business day and a continuation if strong revenues. As fun as April has been…I still think the real story is going to be told in what happens over the May-June period. These months will give us our first glance at the new 2013 tax policy, uncorrupted by year end shenanigans by businesses and individuals. 11%YOY Revenue growth should be the baseline with slightly lower cost.

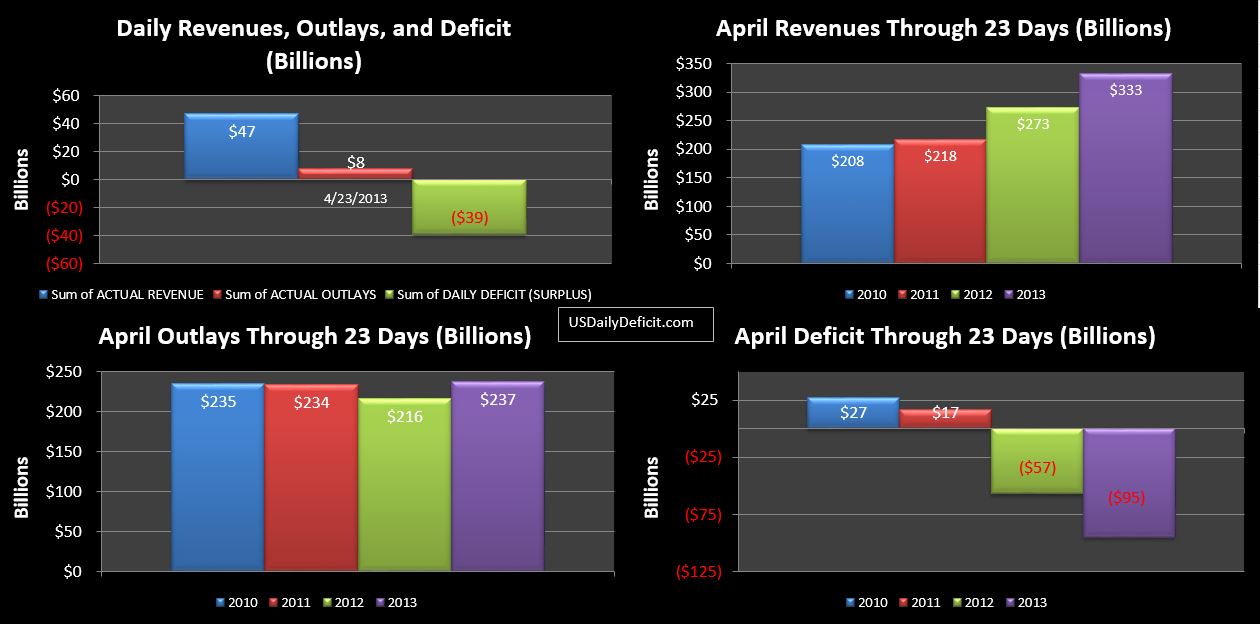

The US Daily Cash Surplus for 4/23/2013 was $39.3B bringing the April 2013 surplus to $95B with 5 business days to go. After a breather yesterday, the large revenue surge I was expecting but unsure of did come through and it exceeded last year by $12B, so another great day. If we can use last year as a guide…which is far from a sure thing…the April revenue party is now pretty much over. We will likely run a small net surplus over the rest of the month, so hitting $100B seems likely. Hitting $120B…possible, but it seems unlikely.

I’ve been using this trick to save about $100 a month for a few years now…thought I’d share the tip with my readers. I know Kroger isn’t national, but they are plentiful here in Texas, and they have been running a lucrative fuel promotion for about 2 years now. It is more or less matched by other stores, including Randalls, but Kroger is more convenient for me, so that’s who I use.

It works like this… For every dollar you spend, you get a point…which can be redeemed for gasoline discounts. If you spend $100 on food, you are eligible for $0.10 off up too 35 gallons of fuel. Who cares you may be thinking…that’s a lot of trouble to save $3.50, plus, Kroger’s prices are probably 10%-20% higher than HEB and Wal-Mart….the math just doesn’t work out.

$3.50 may not be worth your time, but what about the $35 you can save if you have accumulated 1000 points?? Even if you run a daycare, dropping $1000 at Kroger a month is going to be a stretch, but fortunately, they have a special….you can buy gift cards, and earn double points…all the time, and usually every couple months you can get quadruple points. This changes the equation considerably. With double points, you buy a $500 gift card, and you save 35 on your next fuel purchase. Not too shabby. If you hold out for quadruple points….a $250 gift card purchase gets you 1000 points, and $35 off your next gasoline purchase.

Now I can already hear it….”What the heck am I going to do with a $250 gift card? It turns out, Kroger has a crap load of different cards to choose from. I buy cards from places I am planning to spend money anyway. Amazon, Virgin Mobile(my cell provider), and assorted restaurants are what I usually get, but I recently bought $750 of Southwest Airlines for an upcoming trip. You can even buy Target or Shell gas cards, so it’s not really hard to find a card for a place you were going to spend money at anyway. That said, it obviously doesn’t make sense to buy gift cards for something you weren’t going to buy anyway…so don’t get silly.

Let’s run through the math on a best case scenario. Say you have an upcoming trip, and are about to book a $250 ticket on Southwest Airlines with a credit card. Instead, you run to Kroger and buy a $250 Southwest gift card during their 4X points promotion. On the way out, you purchase 35 gallons of gasoline for your truck. Here in Houston, the going price is about $3.30, but you save $1 per gallon. You end up paying $80.50 for your 35 gallons, saving $35, or 30%. Then you go home and book your flight…all in with $35 extra in your pocket.

That’s nice right…but the title clearly says 47%…how do I get to there? Getting to 47% requires a bit more effort on your part. The trick is to use a rewards card that gives you extra cash back at grocery stores. I use the American Express Blue Cash Preferred. It gives you 6% back at grocery stores on up to $6000 per year. (used to be unlimited…boo!!) It has an annual fee, but if you use it like I do, the math works out. There are a ton of other cards out there….every extra % you get is money in your pocket.

So let’s run through the math one more time with a rewards credit card. This time, I show up to the register and in addition to my $250 Southwest gift card, I also purchase a Kroger gift card for $80.50. Why?…I use the card to purchase the gasoline I am about to buy, and thus save 6% on this as well. At the end of the day, I save the $35 I did before, plus 6% of $330.50 ($250+$80.5), an additional $19.83. You should get a credit for this amount on your next billing statement. In this example, I have paid $60.67 (80.50-19.83) for 35 gallons of gasoline that retails for $115.50 (3.3*35). Run the math, and you have saved $54.83, good for 47% savings on your gasoline.

Before you run off to stick it to the man…here are some very important notes:

First and foremost…the $1 discount applies to up to a 35 gallon fuel purchase. If you don’t get 35 gallons, you are leaving money on the table and you will never make it to 47%. That said…unless you drive a V10 Ford Excursion, you probably don’t have a 35 gallon tank. There are two ways to get around this. First is to simply fill up two cars. I have a Suburban with a 31 gallon tank and a Ford Escape Hybrid that I’ve never managed to squeeze more than 13 in. Technically, the fine print says one vehicle, but I’ve never had anyone say anything in over two years and dozens of fillups. This option takes some coordination and drives my wife nuts….but the saving is worth it (to me). The second option is to bring some gas jugs along with you. This option is even more annoying. First, unless you have a truck, you are going to stink up your car, and it’s probably not terribly safe either. Then, when you get close to empty, you have to sit in your driveway for 10 minutes dumping fuel from a jug into your tank. It’s a huge pain, but that hasn’t stopped me yet. Fortunately, I am usually able to make option #1 work.

Another note is timing. Points have to be used in the month earned, or the following month, or you lose them. Their latest 4X offer ended 4/2, which is when I purchased the $750 of Southwest Gift Cards…so I have through 5/31 to use the 3000 points I “earned”. If you let your fuel points expire…you have left $ on the table….so plan accordingly.

Allocation of savings: At the end of the day you have saved $54.83. Was that saved on $115 of gas, $250 of gift cards, or on your credit card as a whole…or some combination of all of the above? The $ stays the same….but the % really depends on how you think about it. Honestly, the % is not that important. What really matters is if going through the hassle of purchasing gift cards and maybe even hauling around jugs of gasoline is worth $54.83 to you.

Finally… and this advice really is not limited to this scenario…putting things on a reward card, and not paying that card off in full every month will significantly reduce your true savings as interest will wipe it out in no time.