The US Daily Deficit for 2/8/2013 was $8.8B, bringing the 8 day total to $85B. This, coincidentally, is about the same amount of annual spending that is supposed to be cut in the dreaded “Sequester”. That’s right…through 8 days of February, we have already run a deficit larger than the amount sequestration is supposed to save over an entire year. If nothing else, it gives you some scale to how puny these cuts really are compared to what is actually needed. If this tiny little $85B cut is going to hollow out our military, increase unemployment and otherwise wreck havok on our economy, just imagine what’s going to happen when the market takes away our ability to deficit spend. Just something to think about.

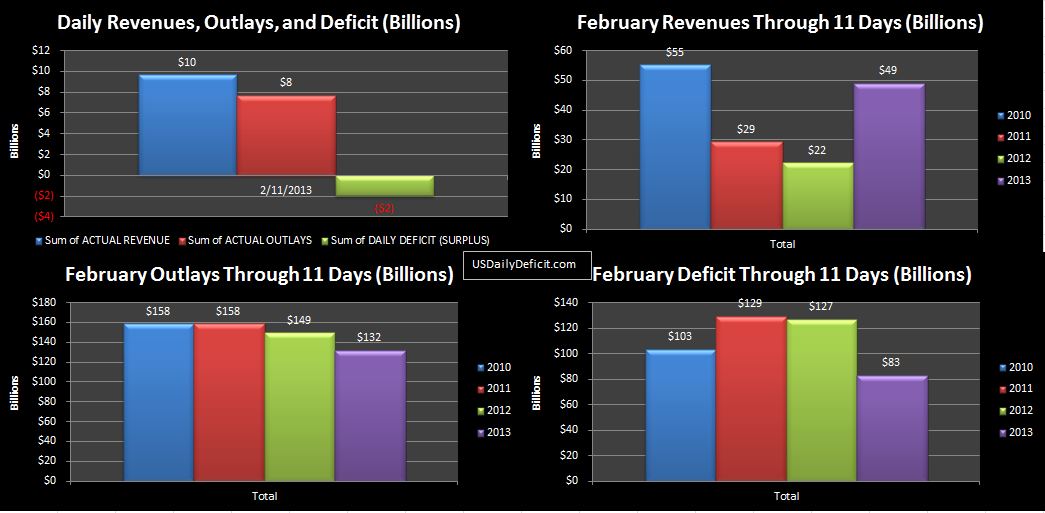

Despite the above reality check, we can see that through 8 days, February 2013 is still $31B below February 2012’s deficit through 8 days. unfortunately, about $20B of that is related to delayed 2013 refunds, and about $10B is due to the timing of social security payments, so adjusting for timing, we are on track with last year. Refunds are starting to accelerate…we’ll know in a few weeks if they will catch up to 2012 or get pushed into March.

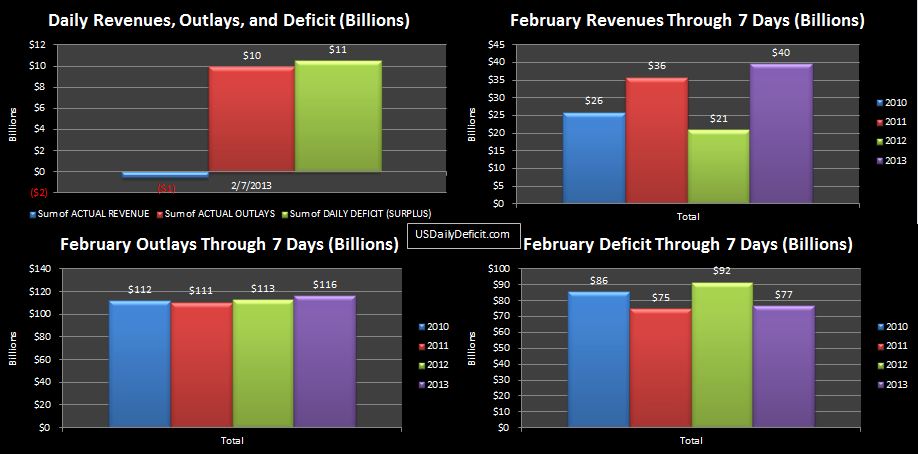

The US Daily Deficit for 2/7/2013 was $10.5B bringing the February cash deficit through 7 days to $77B. With the exception of refunds, everything is pretty much in line with last year. Note that revenue shows as negative today because refunds are higher than tax deposits. Unadjusted revenue is up $3B over last year, so on track to be around $15B or so for the month, which is what we would expect from the recent tax hikes. It’s still too early to start making projections though.

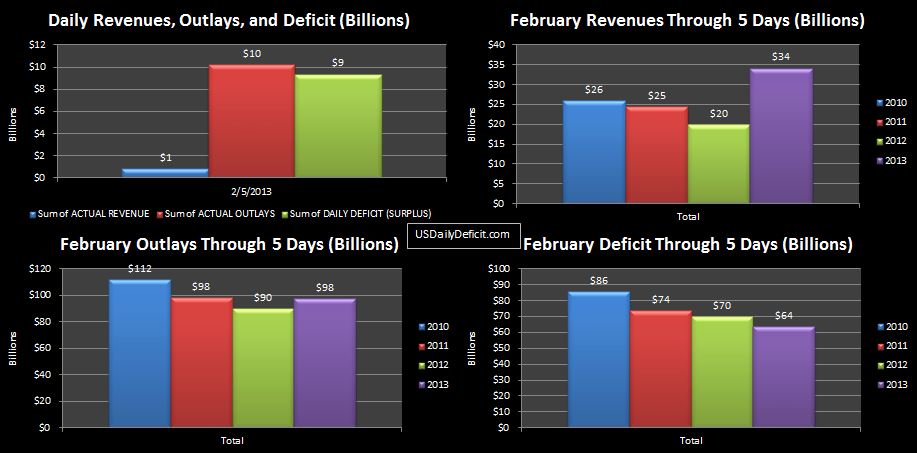

The US Daily Deficit for 2/6/2013 was $2.6B bringing the total deficit through 6 days to $66B, $14B under last year, primarily due to refunds running $12B under last year. I’m not sure yet how this is going to all play out. One possibility is that everybody who usually filed in the middle of January simply filed 1/30, and that we will see a spike in about a week and 2013 will start to catch back up to 2012. The other possibility is that there are system processing constraints that will simply push back everything, meaning that February would never catch up…refunds would just get pushed into March, skewing our monthly profiles and making next year that much more difficult to forecast:) There were $53B of refunds issued in the last 8 calendar days of February 2012, so all else equal, that would put the 2013 deficit ending at around “only” $200B. I’m pulling for the IRS’s refund department to power through so my charts don’t get screwed up for the next 2 years!!