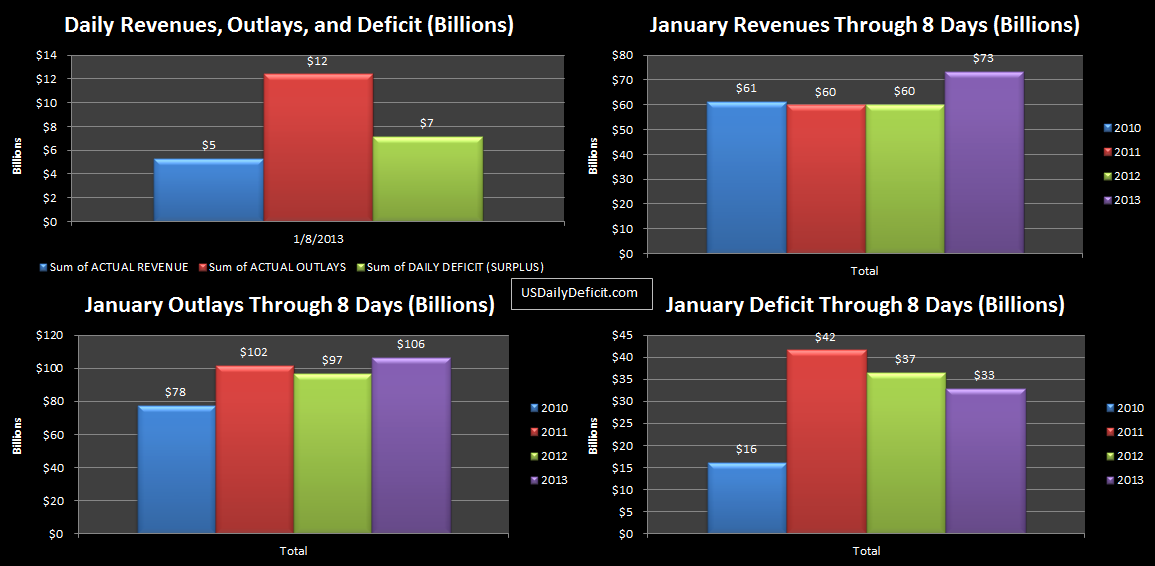

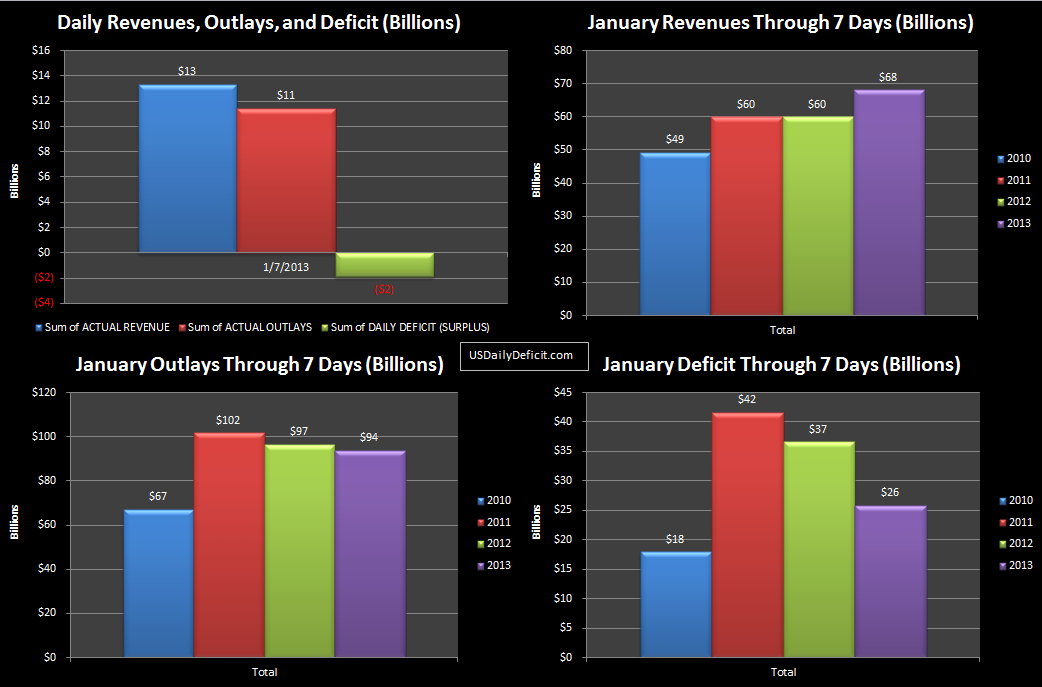

The US Daily Surplus for 1/7/2013 was $1.9B bringing the monthly total through 3 days to $26B. It’s only been four business days, so I wouldn’t get too excited yet, but revenues are up $8B and outlays are down $3B for an $11B improvement over January 2012. The “Debt Limit Cushion” (Cash+ Borrowing Ability) is currently at $64.3B, which using last year as a guide, should get us into the first week of February. I saw a recent announcement from Treasury saying 2/15, so we are pretty much in line, though getting only an additional week out of “extraordinary measures” isn’t all that impressive. I still have not heard anything further on tax refunds being delayed…not sure if that means we are in the clear, but I’ll be filing ASAP just in case.

The US Daily Deficit for 1/4/2013 was $0.7B bringing the monthly total through 3 days to $27.7B. I’ll start putting up charts again tomorrow as we’ll have a week behind us. Before that, comparing years doesn’t really mean much because of the differences in the way weekends and payments fall.

Earlier today I read an article which I can’t find now, but it pretty much said that the fiscal cliff had pulled somewhere around $20B in revenues from 2013 into 2012 as people raced to realize gains before taxes went up. We definately did see a jump in revenue, but with all of the chaos surrounding the tax changes, I’m not sure we’ll even notice a missing $20B in 2013, especially since it would have been spread out over multiple periods. In any case, i’ll be paying very close attention to year on year revenues as soon as we get a few months of 2013 under our belt.

I was watching “Meet The Press” yesterday and during David Gregory’s interview of Mitch McConnell, Gregory was hounding McConnell on whether or not he would use the debt limit as a bargaining tool over the next month. Fair enough, but one thing he kept repeating kept grating against my skull. He kept implying that the reason the US rating was downgraded after the last round was simply because the fight happened in the first place. This is ridiculous. The debt was downgraded because we as a nation have a negative cash flow of about $100B per month and no viable plan to even marginally address this problem. Gregory kept implying that if only Republicans had not made the debt limit an issue, our credit rating wouldn’t have been downgraded. Financial ignorance is nothing new, and since McConnel didn’t call him on it, it’s a pretty safe assumption they are in the same boat. Looking at the facts, it’s a wonder US debt isn’t rated as Junk.

Full Disclosure….a few years back I liquidated about $1k of savings bonds my kids had received from their grandparents for college and purchased silver dollars. I have no regrets.

Sorry for the delay on this one…It took a lot longer to get through the editing process at Seeking Alpha than I expected. Here’s the link.

It’s worth the trouble to get these published at SA first because it it pushes the article, and this site out to a far wider audience that it would get here alone. Also, I get paid per page view, which let’s be honest, isn’t much, but I won’t be sending it back. So click on over and tell all your friends about it!!